Key Takeaways

- The churn rate shows the share of customers who stop using a company’s product or service in a certain period.

- High churn rates can lead to less revenue, higher costs to get new customers, and limits on growth.

- Low churn rates mean good customer loyalty and a solid business model.

- Different things can cause customer churn, so it’s essential to know these reasons to set up the right strategies for keeping customers.

What is the Churn?

What is Customer Churn?

The churn rate, or customer turnover rate, is a vital company metric. It shows how many customers are lost over time (monthly, annually, or less often weekly or daily (so-called the daily churn rate).

This KPI is crucial for businesses, especially those with subscription-based models, as it affects revenue and profitability in the long run.

Why is Churn Rate in Business Important?

The churn rate is crucial for businesses as it tells you about customer happiness, loyalty, and the company’s overall performance.

Having a high churn rate can mess things up in a few ways:

- Revenue drop: Losing customers means losing money that regularly comes in.

- Spending more on getting new customers: It’s usually pricier to get new customers than to keep the ones you’ve got. So, if many customers leave, businesses must keep throwing cash into getting new ones.

- Slower growth: If customers keep ditching you, growing and expanding is hard. Instead of focusing on cool new stuff, the company has to keep replacing the ones that left.

- Falling behind the competition: Unhappy customers might switch to better competitors, leaving you in the dust.

How to Calculate Customer Churn Rate?

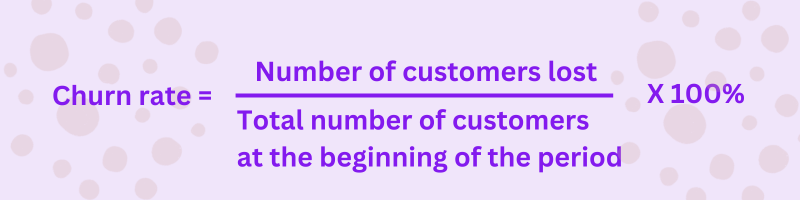

Customer churn rate is calculated by dividing the number of lost customers in a specific time frame by the total customer count at the start of that period, then showing it as a percentage.

Here’s the churn rate formula:

Churn rate = (Number of customers lost) / (Total number of customers at the beginning of the period) x 100.

For instance, if a company started with 1,000 customers and lost 40 by the month’s end, the monthly churn rate would be: Monthly churn rate = (40) / (1,000) x 100 = 4%

The timeframe for calculating the churn rate can vary based on the business and industry. Some companies do it monthly, others quarterly or annually. It all depends on factors like their revenue model, customer lifetime value, sales cycle, and how loyal their customers are.

What Drives Customers to Churn?

Several things can lead to customers leaving, and it’s crucial to grasp these reasons to set up the right strategies for keeping them.

Some common causes of customer churn:

1. Product or service quality concerns: When a product or service doesn’t meet customer expectations or provide value, they might turn to competitors.

2. Perceived lack of value: Customers might leave if they feel they’re not getting enough bang for their buck, whether it’s due to costs, features, or not quite meeting their needs.

3. Issues with customer support: If the service isn’t up to par, slow responses or lack of personal touch can leave customers feeling frustrated and looking elsewhere.

4. Troubles with pricing: Unfair, unclear, or uncompetitive pricing models can push customers away to better alternatives.

5. Rival offerings: When newer and possibly better options arise, customers may be enticed to switch to something that suits them better or offers more value.

How to Reduce / Improve Customer Churn Rate?

Businesses have a few tricks up their sleeves to keep customers returning for more and boost loyalty.

Some strategies to consider:

1. Make Your Product Awesome: Keep tweaking your product based on what customers say, how they use it, and what’s hot in the industry.

2. Be There for Your Customers: Give top-notch, personalized support to build strong bonds and keep them hooked.

3. Rewards and Goodies: Treat your loyal customers with discounts, special deals, or fun perks to keep them happy.

4. Listen Up and Take Action: Chat with customers, gather feedback, and fix any issues pronto to show you care.

5. Smart Moves with Data: Use customer info wisely to spot those who might leave and run targeted campaigns to keep them around.

6. Price It Right and Show Off the Value: Keep an eye on pricing and ensure customers see the great value they’re getting.

7. Get Them Started Right: Offer clear guides and resources to help customers get the most out of your product or service.

What is Churn Analysis?

A churn analysis looks at customer data and behavior to spot patterns that could lead to churn. It means diving into different customer journey data like demographics, usage patterns, feedback, and support interactions to figure out why customers leave and come up with ways to keep them around.

Delving into churn analysis gives businesses critical insights into the following:

1. Customer Segments: Finding which customer groups churn more helps tailor retention efforts to fix specific issues.

2. Churn Triggers: Knowing what leads to customers leaving lets businesses step in early to stop it.

3. Product or Service Issues: Checking customer feedback and usage data uncovers any problems with what a company offers.

4. Customer Lifetime Value (CLV): Understanding what affects how long customers stick around helps focus on the most valuable ones.

5. Competitor Analysis: Keeping an eye on feedback and market trends shows how rivals’ moves might affect churn.

How Can I Track Churn?

Businesses can keep an eye on churn by checking out what customers are up to through different channels and data sources like:

1. Customer Relationship Management (CRM) Systems: These platforms give you a lowdown on customer stuff, such as what they buy, how they talk to you, and how engaged they are.

2. Usage Data: See how customers use your stuff – like how often they log in, what features they like, and how much they’re into it.

3. Survey Responses: Ask customers how they feel with regular surveys to spot problems, find ways to do better, and figure out why they might leave.

4. Support Interactions: Look into support stuff like tickets, chats, and feedback to see what bugs people or makes them mad.

5. Subscription or Billing Data: Keep an eye on renewals, failed payments, and cancellations to understand why customers might leave.

What’s a Good / Reasonable Churn Rate?

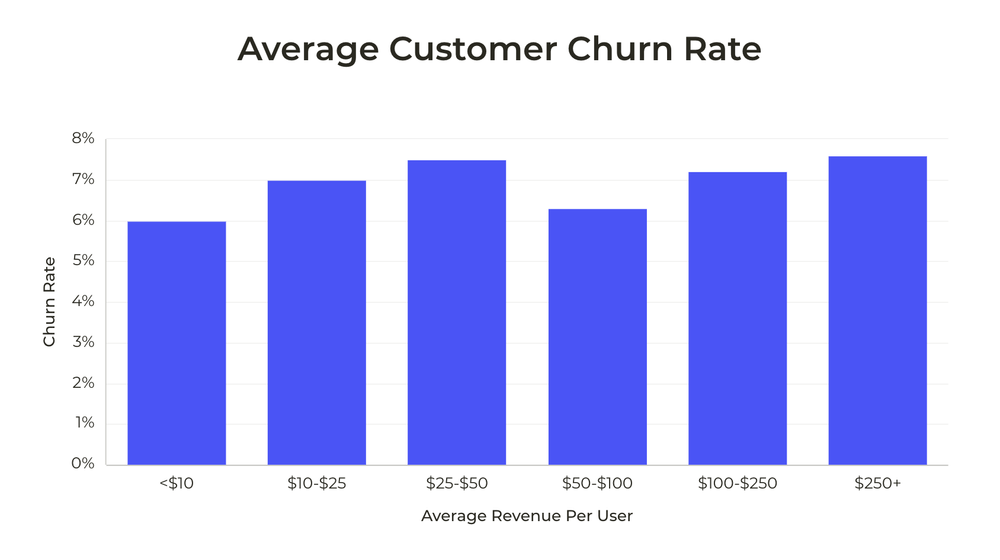

There’s no one-size-fits-all good churn rate – it varies based on industry, business model, and customers.

For mature and established companies, aiming for a churn rate of around 5% to 7% annually and less than 1% monthly is ideal. Early-stage startups or small businesses usually see a churn rate of about 10% to 15%.

Different industries and business models have different benchmarks – some with high switching costs have lower churn rates, unlike those with easy subscription changes.

What Does a High Churn Rate Mean?

A high churn rate is like a warning sign for a business, showing that customers aren’t happy with the product or service and leave too often. Here are some things that can happen with a high churn rate:

1. Revenue Drop: When customers leave, the business loses money regularly, which lowers the total revenue and profits.

2. More Costs to Get Customers: To keep or get new customers? The business has to spend more on getting them than keeping them.

3. Less Room to Grow: If many customers leave, it’s hard for the company to get bigger and better since they’re busy replacing the ones left instead of growing and trying new things.

4. Losing Out to Competition: Unhappy customers who leave might go to other companies with better stuff, making those companies more popular.

5. Bad Reputation: A high churn rate can hurt how people see the company, as unhappy customers might tell others about their bad experiences, stopping potential new customers from joining.

Churn and Other KPIs

What is Churn vs Turnover?

While churn and turnover are related, they’re different beasts.

Churn is all about losing customers who stop using a product or service. Think of it like a subscription service thing.

On the flip side, turnover is broader – it’s about all kinds of departures in a company, like losing customers, employees, you name it. It’s the slow leak of people or assets over time for reasons like quitting, retiring, or just life happening.

When we talk about customers, churn rate hones in on loyalty, while turnover gives the big picture of who’s coming and going in a business.

What is the Difference Between Churn Rate and Retention Rate?

Churn rate and retention rate are like BFF metrics that give different views on customer loyalty and longevity.

Churn Rate is the percentage of customers who say “bye-bye” over time, showing how many are ditching a product or service.

Retention Rate, on the flip side, shows the percentage of customers sticking around with a product or service, giving a peek into how many are hanging on.

It’s like this equation: Retention Rate = 1 – Churn Rate.

If a business has an annual churn rate of 4%, its annual retention rate would be 96%.

Does Churn Rate Affect Retention?

Sure thing! When we talk about churn rate, we’re talking about how many customers decide to stick around. If the churn rate goes up, more folks are saying goodbye, leading to lower retention.

On the flip side, a lower churn rate means more customers are sticking with you, boosting those retention numbers. It’s like a seesaw – churn rate up, retention rate down, and vice versa.

What is the Difference Between Growth Rate and Churn Rate?

Growth rate and churn rate are two metrics that show different sides of how well a business is doing. But they’re like best buds, and looking at them together gives you the full scoop on customer vibes and growth potential.

Growth Rate tracks how fast a business gets new customers or grows its customer base. You can work it out by dividing the new customers gained in a period by the total customers at the start of that period.

Churn Rate is about how fast a business loses customers.

Biz can be booming in growth but still losing customers like crazy, hinting at issues with keeping folks around for the long haul. On the flip side, slow growth with low churn could mean loyal customers but a struggle to grow the gang.

The sweet spot? Balancing solid growth and low churn. That combo signals a smart plan to keep customers and snag new ones. Considerable growth with low churn? That’s the ticket to mega success in the long run.

Customer Churn Rate vs Revenue Churn Rate

Customer churn rate and revenue churn rate are like the cool kids measuring how many friends they lost in a business. The customer churn rate shows the friends who left your circle, while the revenue churn rate is about the money those friends took with them.

If you lose many friends but they don’t bring much cash, that’s a high customer churn rate but a low revenue churn rate. On the flip side, losing a few friends with big wallets means a low customer churn rate but a high revenue churn rate.

What is the Difference Between Attrition and Churn?

Attrition and churn are like cousins when we talk about customer retention and business performance.

Attrition is all about slowly losing customers or employees over time. It happens With customers when they decide not to use a product or service anymore for reasons like not being happy, their needs changing, or finding better options.

Churn, on the other hand, is about how many customers stop using a product or service within a specific period.

Examples of Churn Rate

1. Subscription-based Services:

- Streaming services like Netflix or Spotify: the churn rate shows the percentage of subscribers saying “bye-bye” within a certain time.

- Software-as-a-Service (SaaS) companies: the churn rate watches the percentage of customers hitting pause on their software subscriptions or forgetting to renew their licenses.

- Gyms or fitness clubs: the churn rate is about the percentage of members saying “I’m out” or not coming back.

2. Telecommunications:

- Cable TV or internet service providers: the churn rate counts the customers waving goodbye or changing providers.

- Mobile network operators: the churn rate tracks the subscribers waving farewell to switch networks or hanging up on their mobile services.

3. Financial Services:

- Banks or credit card companies: the churn rate looks at the customers closing their accounts or changing financial tunes.

- Insurance companies: the churn rate measures policyholders saying “no thanks” or skipping the policy renewal.

4. E-commerce and Retail:

- Online retailers or e-commerce platforms: the churn rate keeps an eye on the customers taking a break from shopping or forgetting to check out within a timeframe.

- Subscription box services: the churn rate counts the subscribers hitting pause on their special deliveries or subscriptions.

5. Online Gaming:

- Massively multiplayer online games (MMOs) or virtual worlds: the churn rate is all about the players or users who stop playing within a given period.

Churn rate in SaaS

What is Churn Rate in SaaS?

The churn rate in the Software-as-a-Service (SaaS) industry is about the percentage of customers who decide to cancel or don’t renew their subscriptions within a certain timeframe, like a month or a year. It’s a super important metric for SaaS businesses since it affects their recurring revenue and potential for growth.

What is a Good Churn Rate in SaaS?

A good churn rate in the SaaS industry can vary based on factors like software type, target market, pricing model, and industry standards. Generally, a churn rate under 5% per year is seen as excellent, while rates between 5% and 7% are considered good or acceptable for most established SaaS businesses. Churn rates may shift depending on the subscription term or billing cycle.

SaaS Churn Benchmarks

Based on industry reports and SaaS churn benchmarks, SaaS businesses usually see an average churn rate of 5% to 15% each year. However, this can change a lot depending on factors like how mature the business is, its pricing model, who its customers are, and how tough the competition is.

For instance, new SaaS startups or those going after small businesses might face churn rates of over 10 – 15% yearly as they figure out their product fit and how to get more customers.

On the flip side, established SaaS companies dealing with big clients and long contracts tend to have lower churn rates, often below 5% annually, because of the higher switching costs and the longer sales process.

E-Commerce Churn Rate

In the e-commerce world, the customer churn rate shows how many customers stop buying stuff within a set time, like a year or a quarter. It’s super important for e-commerce businesses because it affects how much customers are worth and how profitable they can be in the long run.

To figure out the churn rate, you take the customers who didn’t buy anything in that time and divide by the total at the start, then multiply by 100 for the percentage.

For instance, if a business had 40,000 customers and 2,000 didn’t buy anything in a year, their churn rate would be 5%: (2000 / 40000) * 100 = 5%

Other Frequently Asked Questions about Churn

Difference between Gross Churn and Net Churn

Gross churn and net churn are like siblings: they are related but not the same. They’re all about tracking how many customers bail on subscription services.

The gross churn rate counts the total customers who ditched at a specific time, ignoring any new ones who joined. You get it by dividing the lost customers by the total customers at the start of that time.

Now, the net churn rate is cooler. It looks at customers lost and new ones gained at that same time. You do the math by subtracting the new customers from the lost ones and then dividing it by the total customers at the start. So, it’s actually better if the net churn rate is negative.

If the gross churn rate is high but the net one is low or negative, it means the business is bringing in enough new customers to make up for the losses, which is a good thing for growth. But watch out if both rates are high – it could mean trouble with keeping customers or getting new ones.

Can You Predict Churn?

Sure, you can predict churn using different analytical techniques and data-driven approaches.

One common way is by using machine learning algorithms and predictive modeling. These algorithms dig into customer data like usage patterns, demographics, payment history, and interactions to spot signs of potential churn risk.

For example, a machine learning model that’s been trained using customer data might flag customers who haven’t logged in recently, raised multiple support tickets, or had billing issues as likely to churn soon.

Another cool method is survival analysis, which predicts how long a customer might stay subscribed. It calculates the chances of churn at various points based on customer traits and behavior.

Businesses can also turn to customer feedback from surveys or NPS scores to pinpoint unsatisfied customers who might churn.

What is a Negative Churn Rate?

A negative churn rate is like hitting the jackpot for a business! It’s when the money from existing customers (thanks to upgrades, add-ons, or expansions) is more than what’s lost from customers leaving or downgrading.

So, even after some customers say goodbye, the overall revenue from existing customers is still climbing. This cool phenomenon is also known as “revenue expansion” or “negative revenue churn.”

To figure out this negative churn rate, businesses need to subtract the money gained from existing customers (from upsells or cross-sells) from the money lost due to customer churn. Then, divide that by the total revenue at the beginning of the period.

For example, a SaaS company started the month with $2 million in monthly recurring revenue (MRR), lost $40,000 because of churn, but gained $80,000 from upsells and expansions.

Their negative churn rate would be -2%.

Negative Churn Rate = [($40,000 – $80,000) / $2,000,000] x 100% = -2%

This negative churn rate shows that the business isn’t just holding onto customers but also making extra cash from them, which is like a rocket booster for growth and profits!

Leave a Reply